LLP Registration Starts from ₹9,999 Only!

A Limited Liability Partnership, or LLP, is an organization that combines the benefits of a business and a standard partnership.

- No Hidden Charges

- Lowest Price Guarantee

- Quick and Hassle-Free Process Free Expert

- Assistance for Lifetime

Get Expert Consultation

How to Register a Limited Liability Partnership (LLP) - Step-by-Step Guide

Registering a Limited Liability Partnership (LLP) involves a series of steps to ensure compliance with legal requirements and to establish the business as a separate legal entity. The first step is to choose a suitable name for the LLP, keeping in mind the guidelines provided by the regulatory authorities. Once a unique name is selected, a reservation application can be filed to secure the name for a specific period. Next, partners need to draft and sign the LLP agreement, which outlines the terms and conditions governing the partnership, such as profit-sharing ratios and decision-making processes. This agreement is a crucial document in the LLP registration process, as it defines the rights and responsibilities of each partner.

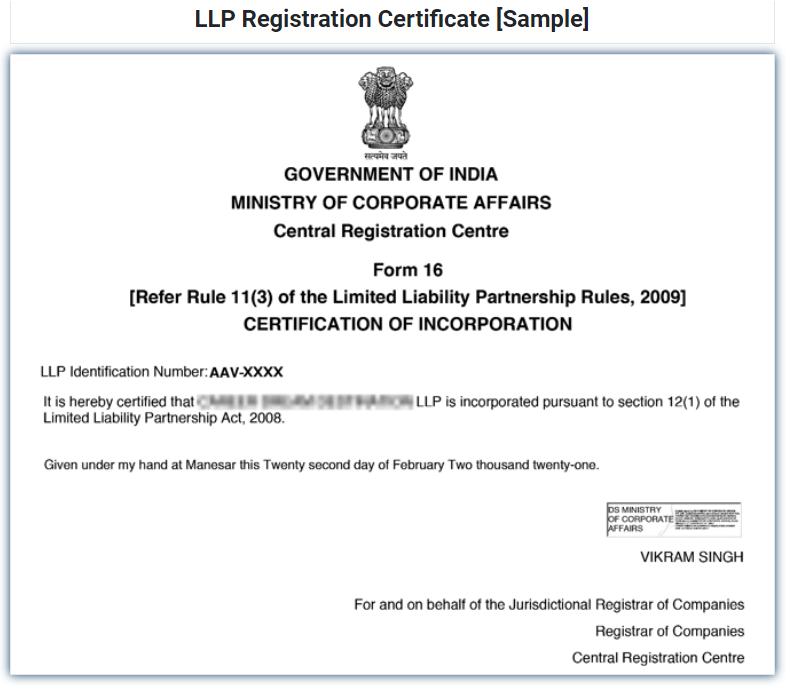

After finalizing the LLP agreement, partners must obtain a Digital Signature Certificate (DSC) and Director Identification Number (DIN) for all designated partners. These digital signatures are essential for filing the electronic forms required during the registration process. Subsequently, partners can file the incorporation documents with the Ministry of Corporate Affairs (MCA), including Form 1 (for reservation of name) and Form 2 (for incorporation).

Alongside these forms, the LLP agreement, details of partners, and consent to act as partners must be submitted. Upon successful verification and approval by the MCA, the Certificate of Incorporation is issued, officially establishing the LLP as a legal entity. Post-registration, partners need to comply with ongoing regulatory requirements, such as filing annual returns and maintaining proper accounting records to ensure the LLP’s continued legal standing. Following these steps diligently helps streamline the LLP registration process and ensures a smooth commencement of business activities.

What is a Limited Liability Partnership (LLP)?

A Limited Liability Partnership (LLP), is an organization that combines the benefits of a business and a standard partnership. Two or more partners must sign an LLP agreement if they agree to form an LLP. An LLP provides its partners a protection that they won’t be held personally liable for corporate debts in excess of their investment. Further, just like a firm, an LLP also continues to exist even if any of the partners leaves or dies. An LLP can have any number of partners (i.e. no upper limit), however, it should have atleast two partners (minimum 2 partners required). One of the authorized partners needs to be a resident of India, and the other two must be natural persons.

What Are the Benefits of Limited Liability Partnership Registration?

1 . Limited Liability Protection: LLP registration provides limited liability protection, shielding individual partners from personal financial liability for the company’s debts and obligations.

2. Separate Legal Entity: An LLP is recognized as a distinct legal entity, separate from its partners, which enhances its credibility and facilitates easier business transactions.

3. Flexible Management Structure: LLPs offer flexibility in their management structure, allowing partners to define roles, responsibilities, and profit-sharing arrangements as per the LLP agreement.

4. Ease of Compliance: LLPs have simplified compliance requirements, reducing the administrative burden on partners, with fewer regulatory formalities compared to other business structures

5. No Minimum Capital Requirement: LLPs do not have a minimum capital requirement, making it cost-effective for startups and small businesses to register and operate.

6. Tax Benefits: LLPs enjoy favorable tax treatment, with profits taxed at the partnership level, avoiding the double taxation associated with certain corporate structures.

7. Perpetual Existence: LLPs have perpetual existence, meaning the death, withdrawal, or insolvency of a partner does not affect the continuity of the LLP.

8. Ease of Transferability: Transfer of ownership or addition of partners is simplified, offering greater flexibility in adapting to changes in business dynamics.

9. Increased Borrowing Capacity: LLP registration enhances the borrowing capacity of the business as it can borrow funds in its own name, leveraging its assets and creditworthiness.

10. Global Recognition: LLP registration enhances the international recognition of the business, making it easier to engage in global transactions and collaborations.

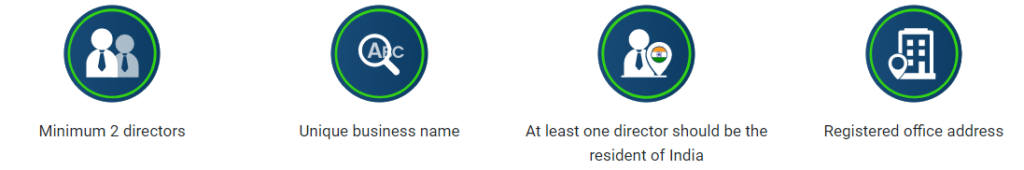

Minimum requirements for LLP registration

As per the Limited Liability Partnership Act, 2008, mandatory compliances to be met for LLP registration are:

What are the Eligibility Criteria for Registering an LLP in India?

To register a Limited Liability Partnership (LLP) in India, certain eligibility criteria must be met. Here are the key requirements:

1. Minimum Number of Partners: At least two individuals or corporate entities are required to act as partners to form an LLP. There is no maximum limit on the number of partners.

2. Designated Partners: Among the partners, there must be a minimum of two designated partners who are individuals, and at least one of them should be a resident of India. Designated partners are responsible for regulatory compliance.

3. Director Identification Number (DIN) and Digital Signature Certificate (DSC): Each designated partner must obtain a unique Director Identification Number (DIN), and all partners must obtain a Digital Signature Certificate (DSC) for electronic filing of documents.

4. Registered Office in India: The LLP must have a registered office in India. This address will be used for official communications, and it should be declared at the time of incorporation.

5. Name Approval: The proposed name of the LLP must be unique and not similar to the names of existing companies or LLPs. It should comply with the guidelines provided by the Ministry of Corporate Affairs.

6. No Minimum Capital Requirement: There is no prescribed minimum capital requirement for forming an LLP. Partners can contribute any amount of capital as agreed upon in the LLP agreement.

7. Annual Turnover and Capital Contribution Disclosure: The LLP agreement must disclose the total monetary value of the contribution from each partner and the total turnover of the LLP.

8. Not Disqualified: Partners or designated partners should not be disqualified under the law from being appointed or continuing as partners in an LLP.

9. Compliance with Applicable Laws: Partners must comply with the applicable laws and regulations related to the formation and operation of an LLP in India.

Meeting these eligibility criteria is essential for a successful LLP registration in India, and adherence to these requirements ensures a smooth and lawful establishment of the business entity.

Documents Required for an LLP Registration

To initiate the registration process for a Limited Liability Partnership (LLP) in India, you need to provide specific documents. Here is a list of essential documents required for LLP registration:

1. Identity and Address Proof of Partners: Copies of PAN cards (for Indians) or passport (for foreign nationals) are required for identity proof. Additionally, utility bills, bank statements, or Aadhar cards can serve as address proof.

2. Photograph of Partners: Passport-sized photographs of all partners are needed for the LLP registration process.

3. Proof of Registered Office: Documents such as rent agreement or sale deed, along with utility bills (not older than two months), should be provided as proof of the registered office address.

4. No Objection Certificate (NOC): If the office premises are rented, a No Objection Certificate from the landlord authorizing the use of the premises for business purposes is required.

5. Subscription Sheet and LLP Agreement: The subscription sheet signed by the partners and the LLP agreement, specifying the rights and duties of partners, must be submitted.

6. Consent to Act as Designated Partners: Consent forms signed by all designated partners, confirming their appointment, are required.

7. Digital Signature Certificates (DSC): All designated partners must obtain a Digital Signature Certificate (DSC) to digitally sign the incorporation documents.

8. Director Identification Number (DIN): Designated partners need to have a valid Director Identification Number (DIN), which is obtained by filing Form DIR-3.

9.Name Approval Certificate: If the LLP name has been reserved prior to registration, the name approval certificate issued by the Registrar of Companies (RoC) should be submitted.

10. Affidavit and Consent: An affidavit from the partners and a consent to act as partners and designated partners are required for LLP registration.

11.Form 2 (Incorporation Document): Form 2, which includes details of the LLP agreement, partners, and registered office, must be filed with the Registrar of Companies.

Ensuring that all these documents are accurate, complete, and submitted as per the regulatory requirements is crucial for a successful LLP registration in India.

Procedure for Registering an LLP

Registering a Limited Liability Partnership (LLP) in India involves several steps. Here is a concise procedure for LLP registration:

1. Name Reservation: Choose a unique name for the LLP and check its availability. File Form 1 with the Ministry of Corporate Affairs (MCA) for name reservation. Once approved, the name is reserved for 20 days.

2. Obtain Digital Signature Certificates (DSC) and Director Identification Number (DIN): All designated partners must obtain their DSC, and at least one designated partner must have a DIN. Apply for DIN by filing Form DIR-3.

3. Drafting LLP Agreement: Prepare the LLP agreement outlining the roles, responsibilities, and profit-sharing arrangements among partners. Ensure it complies with the LLP Act and is signed by the partners.

4. Filing Incorporation Documents: File Form 2 (Incorporation Document) with the Registrar of Companies (RoC). This form includes details about partners, registered office, and LLP agreement. Attach necessary documents, such as consent letters and affidavits.

5.Payment of Fees: Pay the prescribed fees for filing Form 2. The fee amount depends on the contribution and the state in which the registered office is located.

6. Verification by RoC: The RoC will review the documents and, if satisfied, issue the Certificate of Incorporation. This certificate signifies the legal existence of the LLP.

7. PAN and TAN Application: After receiving the Certificate of Incorporation, apply for a Permanent Account Number (PAN) for the LLP and a Tax Deduction and Collection Account Number (TAN) for tax-related purposes.

8. Open Bank Account : Use the Certificate of Incorporation and LLP agreement to open a bank account in the name of the LLP.

9. File LLP Agreement: Within 30 days of incorporation, file the LLP agreement in Form 3 with the RoC.

10. Compliance with Other Requirements: Comply with other post-incorporation requirements, such as obtaining necessary licenses and permits, if applicable.

11.Annual Compliance: Ensure timely filing of annual returns and other statutory documents with the RoC. LLPs are required to file an annual return in Form 11.