Public Company Registration Starts from ₹9,999 Only!

A public company is an organization whose ownership is dispersed among the general public through the sale of shares on stock exchanges, and it is required to adhere to regulatory disclosure and reporting obligations.

- No Hidden Charges

- Lowest Price Guarantee

- Quick and Hassle-Free Process Free Expert

- Assistance for Lifetime

Get Expert Consultation

How to Register a Public Company - Step-by-Step Guide

Registering a public company in India involves several steps, and it’s important to follow the regulatory requirements. Here is a general step-by-step guide:

1.Obtain Digital Signature Certificate (DSC): Apply for a digital signature certificate for the proposed directors and shareholders.

2. Director Identification Number (DIN): Apply for Director Identification Number (DIN) for all proposed directors.

3. Name Approval: Submit an application for the availability of the company name to the Ministry of Corporate Affairs (MCA).

4. Drafting Memorandum and Articles of Association: Prepare the Memorandum of Association (MOA) and Articles of Association (AOA) of the company.

5. Filing Incorporation Documents: File the required documents, including the MOA, AOA, and other necessary forms, with the Registrar of Companies (RoC).

6. Payment of Fees: Pay the prescribed fees for the incorporation process.

7. Verification of Documents: The RoC will verify the documents, and if everything is in order, they will issue the Certificate of Incorporation.

8. Issue of Certificate of Incorporation: Once the RoC is satisfied, they will issue the Certificate of Incorporation, officially recognizing the company as a legal entity.

9. Apply for PAN and TAN: Apply for the company’s Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN).

10. Make a Commencement of Business Declaration: File a declaration of the commencement of business with the RoC.

11. Listing on Stock Exchanges (if applicable): If the company intends to list its shares on stock exchanges, it needs to comply with the listing requirements of the respective stock exchange(s).

12. Compliance with Securities and Exchange Board of India (SEBI) Regulations: Ensure compliance with SEBI regulations if the company is issuing securities.

13. Appointment of Auditors: Appoint auditors for the company within 30 days of incorporation.

14. Statutory Compliance: Comply with other statutory requirements and ongoing compliance obligations, such as filing annual returns, financial statements, etc.

15. Continuous Compliance: Ensure ongoing compliance with the Companies Act, SEBI regulations, and other applicable laws.

What is a Public Company?

A public company, also known as a publicly traded company or a public corporation, is a type of business entity whose ownership is divided into shares of stock that are freely traded on a stock exchange or over-the-counter market. The shares are available for purchase by the general public, allowing a wide range of investors to become partial owners of the company.

What Are the Benefits of Public Company Registration?

1. Access to Capital: Public company registration in India provides access to a broader pool of capital through the issuance of shares to the public, facilitating funding for expansion, research, and strategic initiatives.

2. Enhanced Visibility and Prestige: Public companies gain heightened visibility and prestige, attracting attention from investors, customers, and business partners, potentially boosting credibility in the market.

3. Liquidity for Shareholders: Shareholders of public companies enjoy liquidity as they can easily buy or sell shares on stock exchanges, providing an exit strategy and increased marketability of their investments.

4.Employee Stock Options (ESOPs): Public companies can use Employee Stock Option Plans (ESOPs) as a tool for employee retention and motivation, offering stock options as part of employee compensation.

5. Mergers and Acquisitions (M&A) Opportunities: Public status enhances a company’s ability to engage in mergers and acquisitions by using its shares as a form of currency for strategic deals and business combinations.

6. Valuation and Stock-Based Financing: Publicly traded companies often experience higher valuation multiples, enabling them to use their stock as collateral for loans and other forms of financing.

7. Increased Investor Base: Public companies attract a diverse investor base, including institutional investors, mutual funds, and individual retail investors, broadening the company’s ownership structure.

8. Employee Recruitment and Retention: Public listing can aid in attracting top talent, as employees may be drawn to the perceived stability, transparency, and potential financial benefits associated with working for a publicly traded company.

9. Regulatory Compliance and Governance: Public companies are subject to regulatory oversight, promoting adherence to corporate governance standards and transparency, which can build trust among stakeholders.

10.Market Recognition and Brand Enhancement:

– Public company registration often leads to increased market recognition and a strengthened corporate brand, which can positively impact customer relationships and market competitiveness

Minimum requirements for Public Company registration

The following are some of the general minimum requirements for public company registration in India:

- Minimum Number of Directors

- Minimum Number of Shareholders

- Authorized and Paid-Up Capital

- Director Identification Number (DIN)

- Digital Signature Certificate (DSC)

- Name Approval

- Memorandum of Association (MOA) and Articles of Association (AOA)

- Declaration of Compliance and Statutory Declaration

- Registered Office

- Payment of Fees

- Appointment of Auditors

Documents Required for an Public Company Registration

Registering a public company in India involves the submission of various documents to the Registrar of Companies (RoC). Here is a general list of documents typically required for the registration of a public company in India:

- Identity Proof of Directors and Shareholders:

– Copy of PAN (Permanent Account Number) card

– Copy of Aadhaar card or passport

- Address Proof of Directors and Shareholders:

– Copy of passport, voter ID, or driver’s license

– Recent utility bill (electricity, water, or gas bill) or bank statement

- Passport-sized Photographs:

– Passport-sized photographs of all directors and shareholders

- Digital Signature Certificates (DSC):

– DSC for each director and authorized signatory

- Director Identification Number (DIN):

– Copy of DIN for each director

- Name Approval Application:

– Form for name approval along with the application fee

- Memorandum of Association (MOA) and Articles of Association (AOA):

– MOA and AOA drafted and signed by the subscribers

- Declaration of Compliance:

– Declaration of compliance with the requirements of the Companies Act

- Statutory Declaration:

– Statutory declaration regarding the correctness of the information provided

- Registered Office Address Proof:

– Copy of the rental agreement or sale deed for the registered office address

– NOC (No Objection Certificate) from the property owner

- Board Resolution:

– Board resolution approving the MOA, AOA, and other incorporation-related matters

- Power of Attorney:

– If applicable, a power of attorney granted by subscribers for someone to act on their behalf during the incorporation process

- Affidavit from Subscribers and First Directors:

– Affidavits from subscribers to the memorandum and first directors confirming compliance with the provisions of the Companies Act

- Payment Receipts:

– Copies of challans or payment receipts for the filing fees and stamp duty

- Auditor’s Consent:

– Consent from the proposed auditor of the company

- Appointment of Directors and First Directors:

– Consent to act as directors and first directors of the company

Procedure for Registering Public Company

Registering a public company in India involves several steps, and it’s crucial to follow the procedures outlined by the Ministry of Corporate Affairs (MCA) and the Registrar of Companies (RoC). Here is a general procedure for registering a public company in India:

- Obtain Digital Signature Certificates (DSC):

– Obtain DSC for all proposed directors. This is necessary for digitally signing the electronic incorporation documents.

- Obtain Director Identification Number (DIN):

– Apply for DIN for all proposed directors. This is done through the MCA by filing Form DIR-3.

- Name Approval:

– Choose a unique and available name for the company and apply for name approval with the RoC by filing Form RUN (Reserve Unique Name).

- Drafting Memorandum of Association (MOA) and Articles of Association (AOA):

– Draft the MOA and AOA, which define the company’s objectives and rules. Ensure that the documents comply with the Companies Act.

- Filing Documents for Incorporation:

– Prepare and file the following documents with the RoC within 20 days of name approval:

– Form SPICe (INC-32): Integrated Incorporation Form

– Form SPICe MOA (INC-33): MOA

– Form SPICe AOA (INC-34): AOA

- Payment of Fees:

– Pay the prescribed fees for filing the incorporation documents. The fee structure may vary based on the authorized capital.

- Verification of Documents:

– The RoC will verify the submitted documents. If any discrepancies are found, the applicant may be asked to rectify them.

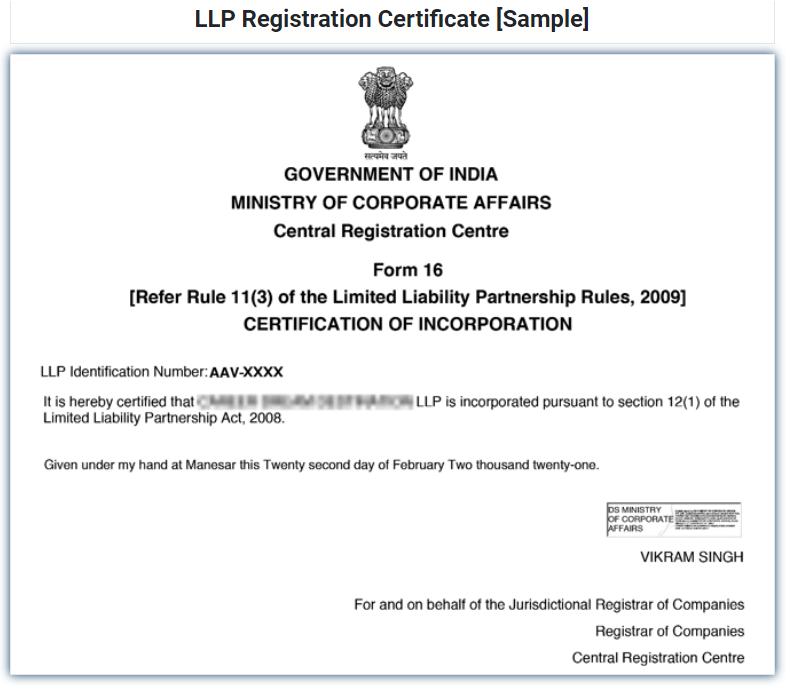

- Certificate of Incorporation (COI):

– Once the RoC is satisfied with the documents, they will issue the Certificate of Incorporation (COI), officially recognizing the company’s existence.

- Apply for PAN and TAN:

– Apply for the company’s Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) with the respective authorities.

- Make a Commencement of Business Declaration:

– File a declaration of commencement of business with the RoC, stating that the company has started its operations within 180 days of incorporation.

- Appointment of Auditors:

– Within 30 days of incorporation, appoint auditors for the company and file Form ADT-1 with the RoC.

- Listing on Stock Exchanges (if applicable):

– If the company intends to list its shares on stock exchanges, it needs to comply with the listing requirements of the respective stock exchange(s).

- Compliance with Securities and Exchange Board of India (SEBI) Regulations:

– Ensure compliance with SEBI regulations if the company is issuing securities.

- Continuous Compliance:

– Ensure ongoing compliance with the Companies Act, SEBI regulations, and other applicable laws.