Private Limited Company Annual Compliance

Annual Compliance for Private Limited Companies

The submission of both forms is required to report the activities and financial data for the respective Financial Year. The deadlines for the annual filing of a company depend on the date of the Annual General Meeting. Persistent failure to comply may result in the removal of the company’s name from the RoC’s register, along with the disqualification of directors. Additionally, it has been noted that the Ministry of Corporate Affairs (MCA) has proactively implemented robust measures to address such failures.

- Transparent Pricing

- Guaranteed Lowest Prices

- Efficient and Trouble-Free Process

- Expert Assistance at No Additional Cost for a Lifetime

Get Expert Consultation

Private Company Annual Compliance: Understanding the Requirements

A Private Company is an independent entity that must maintain its active status through regular filings with the Ministry of Corporate Affairs (MCA). Every company, regardless of its turnover, is obligated to submit an annual return and audited financial statements to the MCA for each financial year, even if there are zero transactions. Annual compliances for private limited companies are mandatory, irrespective of the number of transactions undertaken.

Both forms are filed to report activities and financial data for the relevant financial year. The deadlines for annual filing are determined by the date of the Annual General Meeting. Persistent non-compliance may result in the removal of the company’s name from the MCA’s register, along with the disqualification of directors. The MCA has demonstrated a proactive approach in addressing such failures.

Annual Compliance Requirements for Private Limited Companies

1) Auditor Appointment (to be completed within 15 days of Incorporation)

2) Annual ROC Filing Deadline (October 29, 2022)

a) Submission of Annual Returns

b) Furnishing Financial Statements

3 ) Annual General Meeting (AGM)

4) Board Meetings

5) Directors’ Reports

6) Income Tax Filing Deadline (November 7, 2022)

7) Record Maintenance

8) Adherence to Other Compliance Requirements

Compliance Requirements for a Private Limited Company.

Navigating the intricacies of mandatory compliances is a crucial aspect for most companies, and at 10XFiling, we have a team of expert chartered accountants, taxation professionals, and company secretaries ready to handle all your compliance requirements. Our top-notch legal consultation ensures that your company adheres to the mandated regulations set by the Ministry of Corporate Affairs and other government departments.

Board of Directors Meetings Facilitation:

Initiating with the first meeting within 30 days of incorporation, subsequent quarterly meetings in a calendar year are essential, with no more than 120 days between consecutive meetings.

Minutes of Meeting Proceedings:

Maintaining and filing meeting minutes permanently at the registered office is mandatory, adding significant value in potential dispute situations.

Share Certificate Issuance:

Within 60 days of incorporation, the company is obligated to issue share certificates to the memorandum subscribers.

Directors’ Interests Disclosures and Disqualification Declarations Filing:

In the inaugural board meeting, directors must disclose their interests in other businesses.

Commencement of Business Declaration Filing with RoC:

Mandatory filing using Form INC 20A within 180 days of incorporation.

Annual General Meetings Facilitation:

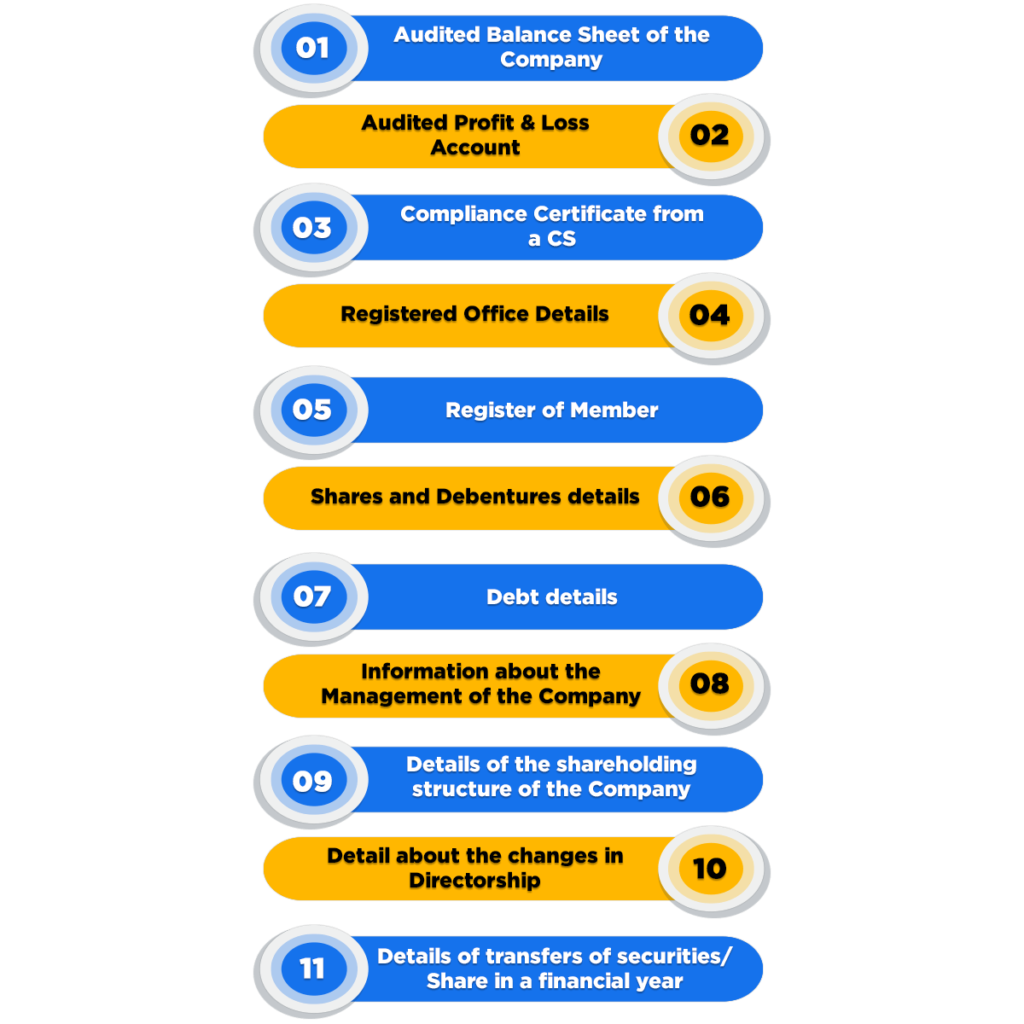

Annual Return Filing:

Filing the Annual Return with the Registrar of Companies within 60 days of the AGM in E-Form MGT-7. Companies with a turnover of INR 50 Crore or more require certification by a Practicing CS in Form MGT-8.

Quarterly Compliance:

A minimum of four board meetings per calendar year, ensuring at least one meeting per quarter.

GST Filings:

Companies with GST registration must file GSTR-1 and GSTR-3B monthly, with an annual GSTR-9 filing requirement.

TDS Filings:

Mandatory submission of TDS returns to the Income Tax Department on a quarterly basis, with accuracy and timeliness crucial to avoid penalties.

Payroll-Related Filings:

Companies subject to payroll compliances such as PF, ESI, PT, etc., must file monthly and quarterly returns.